NSE Option Chain Trading Tools and Resources: Enhancing Your Trading Experience

Option chain trading on the National Stock Exchange (NSE) can be a complex endeavor, requiring traders to stay informed and make informed decisions. Fortunately, there are a variety of tools and resources available that can enhance your trading experience and help you navigate the option chain more effectively. Check what is demat. From research platforms to analytical tools, these resources can provide valuable insights and improve your trading strategies. Here are some essential tools and resources for NSE option chain trading:

Trading Platforms: A reliable and user-friendly trading platform is essential for executing trades efficiently. Look for platforms that offer real-time data, advanced charting capabilities, and customizable interfaces. Popular trading platforms like Zerodha, ICICI Direct, and Upstox provide access to the NSE option chain and offer a range of features to enhance your trading experience.

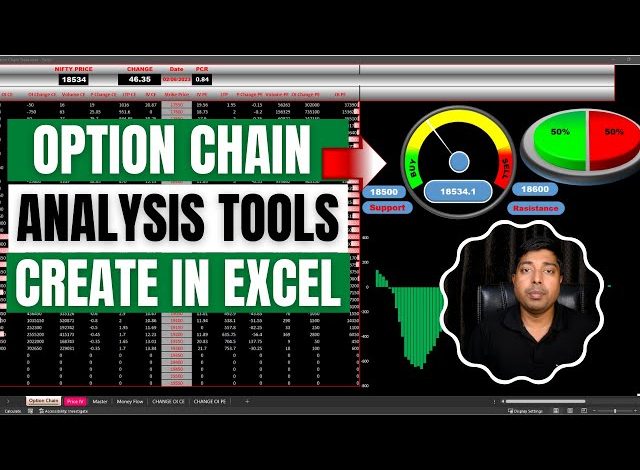

Option Chain Analysis Tools: Option chain analysis tools provide detailed insights into the option chain and help traders make informed decisions. These tools allow you to analyze key metrics such as open interest, volume, and premiums associated with each option contract. They also provide graphical representations of option chain data and allow you to identify trends and patterns. Some popular option chain analysis tools include Sensibull, OptionAction, and NiftyTrader. Check what is demat?

Research Platforms: Research platforms offer a wealth of information and analysis on stocks, sectors, and market trends. They provide access to company financials, news, and expert analysis. Utilizing research platforms can help you stay updated with market developments, news events, and earnings reports that can impact the option chain. Popular research platforms in India include Moneycontrol, Economic Times, and BloombergQuint.

Technical Analysis Tools: Technical analysis tools are essential for analyzing price patterns and identifying potential trading opportunities. These tools help traders identify support and resistance levels, trend lines, and other technical indicators. They can assist in generating trading signals and timing entry and exit points. Platforms like TradingView, ChartIQ, and AmiBroker provide a wide range of technical analysis tools and features. Check what is demat?

Volatility Calculators: Volatility is a critical factor in option chain trading. Volatility calculators help traders gauge the implied volatility of options and make informed trading decisions. These tools allow you to assess the expected price range of an option based on its implied volatility. Popular volatility calculators include the Black-Scholes model and the Implied Volatility Calculator available on various trading platforms.

Option Pricing Models: Option pricing models help traders determine the fair value of options and assess their potential profitability. These models take into account factors such as the stock price, strike price, time to expiration, interest rates, and volatility. The Black-Scholes model and the Binomial option pricing model are widely used in option chain trading to calculate option prices and assess their intrinsic value. Check what is demat?

Trading Communities and Forums: Engaging with trading communities and forums can provide valuable insights and foster learning. These platforms allow traders to share ideas, discuss trading strategies, and learn from experienced traders. Platforms like Trading Q&A, Stocktwits, and Elite Trader offer a community-driven approach to trading, where traders can ask questions, share experiences, and gain insights into option chain trading.